Streamline and Automate

Real-Time Trade Processing

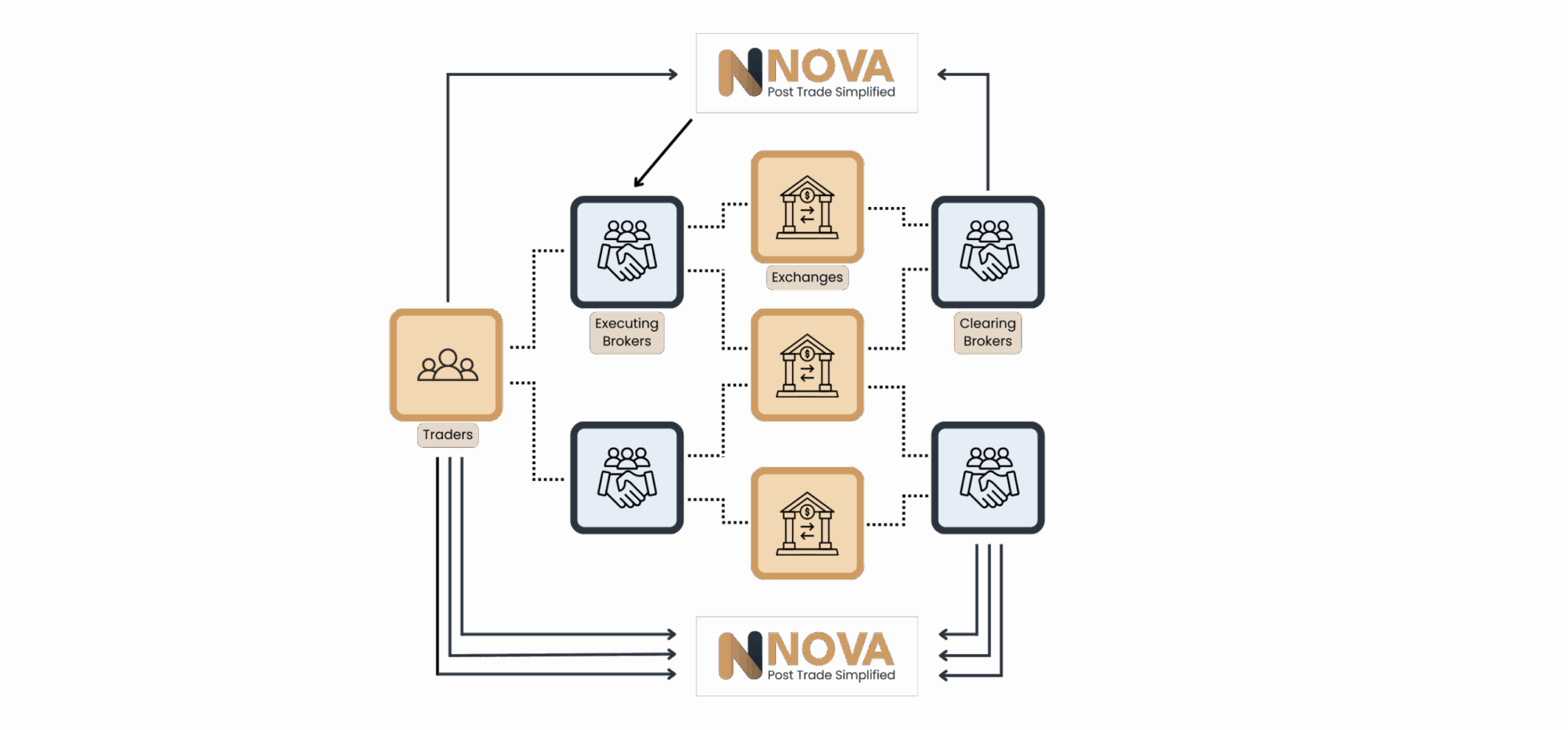

NOVA Trade encompasses features related to the initiation and management of client and market transactions, utilising both manual input and automated procedures (subject to Stock Exchange regulations). It offers capabilities such as automated computation of all market transactions based on stock exchange actions, comparison of executions against client trades/orders for consistency, customizable contract notes and trade confirmations, and additional functionalities.

Benefits

Trading

Supports both Agency and Principal NOVA Trade supports both Agency and Principal trading from the entry of Agency and Principal trade legs to the monitoring and revaluation of Principal positions in the NOVA Book module.

Auto-Management of Exceptions

Multi-Market, Multi-Currency, Multi-Entity

Features

Pick-List of Unmatched Executions for the Market Side of a Trade

One-to-One, One-to-Many and Many-to-Many Trade Matching

On Screen Reconciliation of Market Executions & Client Trades/Orders

Entry of Block or Confirmed [Allocated] Trade

On Screen Modification of Settlement Instructions

Speciy Charges by Client or Instrument

Price Tolerance Verification

Exchange Rate Tolerance Verification

Accrued Interest for Fixed Interest

Futures and Options: Margins

Automatic Upload of Market Executions

Trade Confirmations and Contract Notes

Trade Reports Generations

Trade Execution Allocations

FX Trade Booking & Allocation

Matching of Executions to Client Trades or Orders

Automatic Generation of Settlement Instructions(SI)