NOVA SBL

Stock lending and borrowing, also known as securities lending, is a financial mechanism where you allow another party—typically a financial institution—to temporarily borrow stocks that you already own. In return, you receive a fee for this arrangement. Think of it as “renting” out your stocks for institutions or other parties to use. NOVA Stock Borrowing & Lending module supports the broker in lending their own stock and borrowing stock to support their market making operation or to reduce failed settlement. Stock Loan transactions are entered as stand-alone transactions with only Principal trades – between an internal, house book and the market, being supported. The SWIFT messaging for reporting SBL transactions for settlement is highly automated with the settlement revaluation and return all being processed on the back of messages received from Stock exchanges (e.g.: Euroclear UK & Ireland system, CREST).

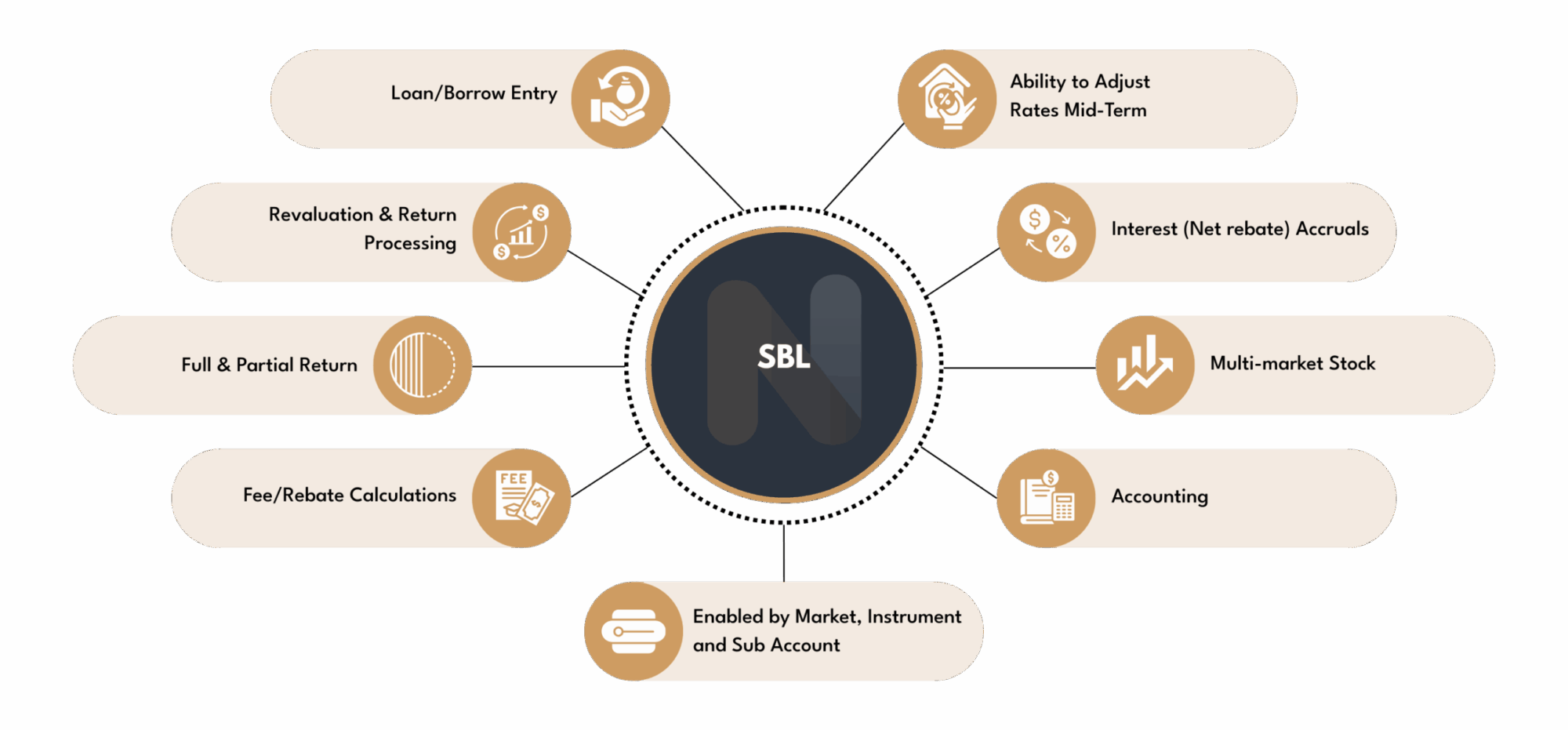

Features

Benefits

End-to-End STP to reduce manual workload

Real-time APIs to automate SBL processing

Improve Operational Efficiency

with automated Straight-Through Processing and multi tier architecture