Automate Complete Margin & Collateral Management Workflow

Initial Margin Requirements & Calculations

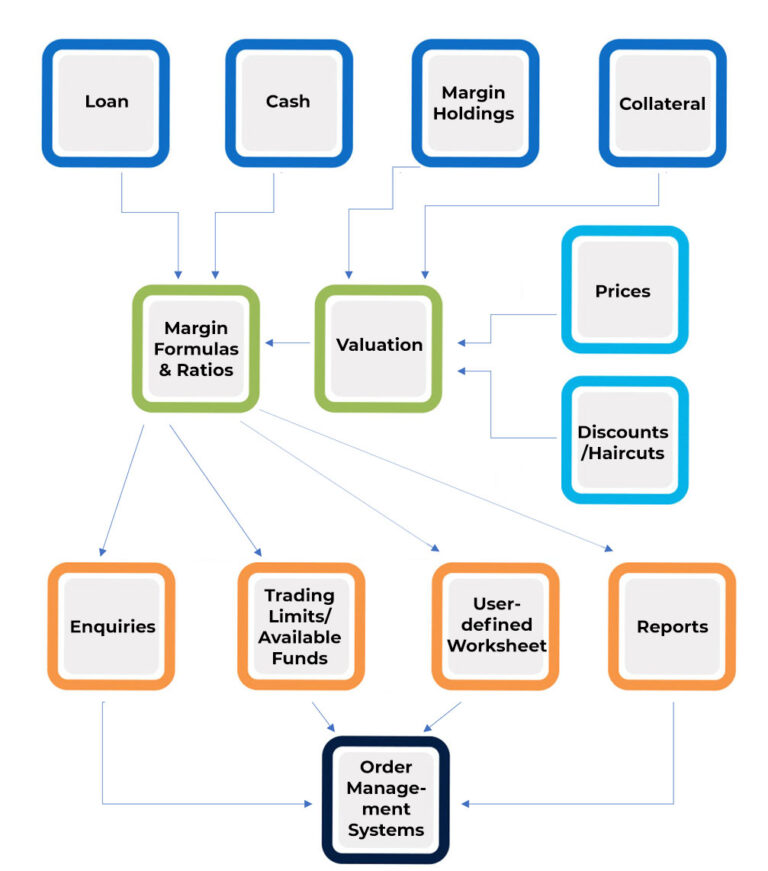

Define your own limits based on business tolerance. System auto generates flags for margin calls; auto adjustment of price for valuations; allows configuring trading limits/available funds setup.

Risk Management & Regulatory Compliances

Maximize efficiency by optimizing counterparty risk exposure, reducing the expenses of funding initial margin and capital requirements, all while mitigating systemic risk.

Collateral Management & Portfolio Reconciliation

Looking for lowest latency connectivity, minimal risk and improve certainty of execution with >99.99% up-time?

NOVA Margin is built around an extremely flexible model which has already satisfied the unique requirements of clients in Hong Kong, Malaysia, Singapore and New Zealand. This model has been designed to provide functions that allow significant extensions, as described below, without the necessity to modify the underlying NOVA structures and processes.

Structure & Key Features of NOVA Margin

Features

Loans Processing

Auto Adjustment of Price for Valuations

Configurable Trading Limits/Available Funds Setup

Consolidated view of Margin Transactions

Support of User defined Worksheet

Margin Group Maintainance

Daily Margin Maintaince

Weighted Asset Interest Computation

Flexible Interest/Accrual Calculation

Benefits

End-to-End STP, which reduces the manual workload

Flexible Real-time API available for upstream and downstream system

Full audit trail of transaction workflows

Ability to define and auto calculate Asset based interest processing

In-built reports on summarised Margin data & Client Defined Static Data

Rule based Margin call calculation

Improve Operational Efficiency

with automated Striaght Through Processing and multi tier architecture

Reduce Cost

operate more efficiently, and minimise risk with cloud-hosted infrastructure

Scalable & Future-Ready

with multi tier architecture enabling load balancing and increased security

Lower Security Risks

multi tier architecture that isolates critical data under several encrypted layers

Strong Clearing & settlement

ecosystem with direct interface with all major CSDs across APAC

Improve Compliance

to ever-eveolving regulatory requirements across multiple jurisdictions